Homeowners Insurance in and around Asheboro

If walls could talk, Asheboro, they would tell you to get State Farm's homeowners insurance.

Help cover your home

Would you like to create a personalized homeowners quote?

- Asheboro

- Liberty

- North Carolina

- Ramsuer

- Siler City

- Pittsboro

- Denton

- Apex

- Randleman

- Greensboro

- Seagrove

- Burlington

- Graham

- Chapel Hill

- High Point

- Troy

- Pinehurst

- Southern Pines

- Sanford

- Wayford

Insure Your Home With State Farm's Homeowners Insurance

None of us can see what we will encounter in the future. That’s why it makes good sense to plan for the unexpected with a State Farm homeowners policy. Home insurance protects more than just your home's structure. It protects both your home and your valuable possessions. If your home is affected by a fire or falling trees, you could have damage to some of your belongings on top of damage to the structure itself. If your belongings are not insured, you may struggle to replace all of the things you lost. Some of your valuables can be protected from theft or loss outside of your home, like if your bicycle is stolen from work or your car is stolen with your computer inside it.

If walls could talk, Asheboro, they would tell you to get State Farm's homeowners insurance.

Help cover your home

Why Homeowners In Asheboro Choose State Farm

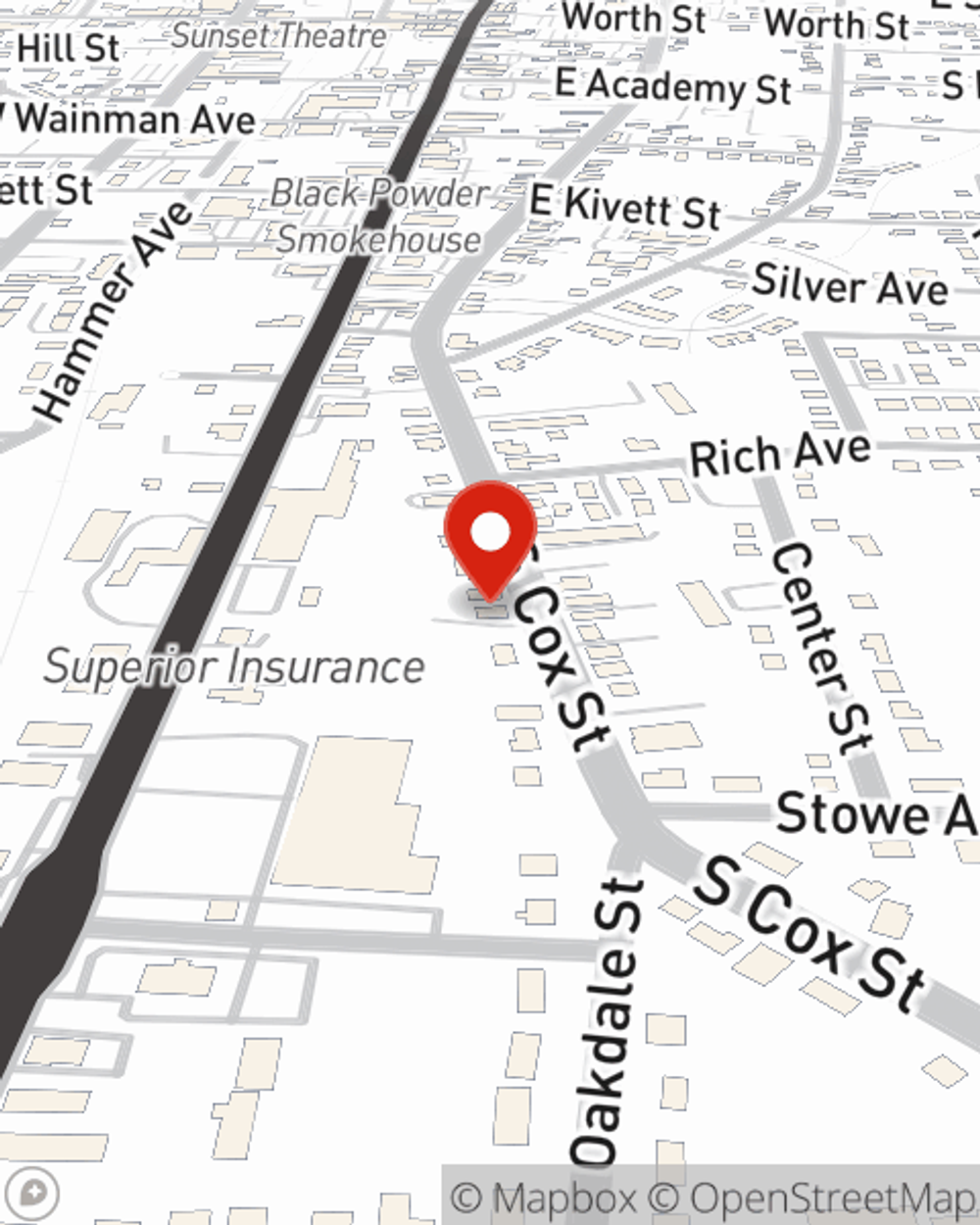

If you're worried about handling the unexpected or just want to be prepared, State Farm's terrific coverage is right for you. Forming a policy that works for you is not the only aspect that agent Josh Murray can help you with. Josh Murray is also equipped to assist you in filing a claim when troubles do come.

Asheboro, NC, it's time to open the door to dependable protection for your home. State Farm agent Josh Murray is here to assist you in understanding the policy that's right for you. Contact today!

Have More Questions About Homeowners Insurance?

Call Josh at (336) 629-3660 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Home inspection: What's included and not?

Home inspection: What's included and not?

Consider a professional home inspection to help identify any immediate or potential issues before signing the papers on a new house.

Josh Murray

State Farm® Insurance AgentSimple Insights®

Home inspection: What's included and not?

Home inspection: What's included and not?

Consider a professional home inspection to help identify any immediate or potential issues before signing the papers on a new house.